Table of Contents

Key Takeaways

- Conditional payments in WooCommerce let you control which payment methods appear at checkout based on rules like location, order value, customer role, or product type.

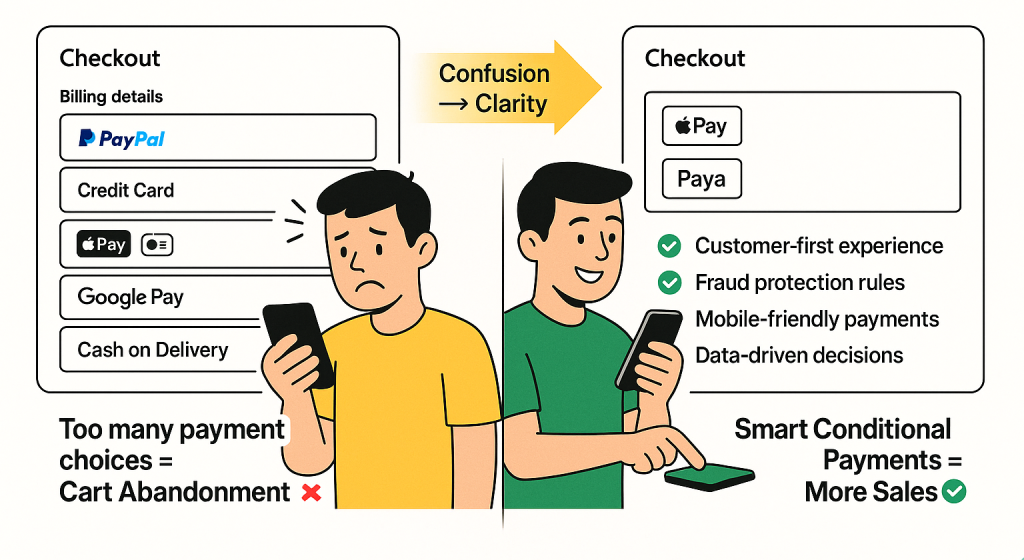

- Smarter payment rules reduce cart abandonment by showing customers only the options that fit them.

- Conditional payments also reduce fraud risks by blocking high-risk methods in flagged regions or for suspicious orders.

- You can save on transaction fees by restricting costly gateways for small orders and encouraging secure, low-cost options for bulk purchases.

- Tools like Dotstore’s Conditional Payments for WooCommerce plugin make it simple to set up flexible rules without coding, improving both checkout experience and store profitability.

Offering the right payment methods can make shopping easier for your customers and help your business run more smoothly. When customers see payment options that fit their needs, they are more likely to complete their purchases. WooCommerce conditional payment rules help solve tricky challenges, like blocking risky payment methods in certain areas, offering special options for wholesale buyers, or setting rules based on order amounts.

Dotstore’s Conditional Payments for WooCommerce plugin makes it simple to set up these strategies. With this tool, you can customize payment options, make checkout easier, improve security, and increase your store’s sales. This blog will show you how to use the plugin to set up and manage WooCommerce conditional payment rules that work for your business.

Why choose WooCommerce conditional payment rules for stores

Controlling payment methods can make a big difference for your WooCommerce store. With flexible payment options in place, your customers feel more confident, and the chance of cart abandonment reduces. In fact, businesses to lose up to 22% of sales complicated checkout processes can cause .

WooCommerce conditional payment rules also help prevent fraud. For example, blocking certain payment methods in high-risk regions can reduce chargebacks, while setting minimum or maximum order amounts can stop fraudulent transactions. These rules protect your store while keeping things smooth for real customers.

You can also use payment controls to save money. For instance, you might block expensive payment options for low-margin products or encourage specific payment methods for high-value orders to reduce fees and increase profits.

Finally, showing customers the payment options they prefer builds trust and makes checkout easier.

Strategic payment method control isn’t just about convenience, it’s a crucial security measure. Merchants who implement WooCommerce conditional payment rules can significantly reduce their fraud exposure while maintaining a smooth checkout experience for legitimate customers.

Nimesh Patel, Product Growth Manager at Dotstore

Installing and configuring the Conditional Payments for WooCommerce plugin

Conditional Payments For Woocommerce

Reduce risk and supercharge your conversions with strategic payment limitations.

14-day, no-questions-asked money-back guarantee.

To implement WooCommerce conditional payment with Dotstore’s Conditional Payments for WooCommerce plugin, follow these simple steps:

- Download the plugin from Dotstore’s official website or your WordPress admin dashboard.

- Navigate to Plugins > Add New, and click on Upload Plugin.

- Select the downloaded file, click Install Now, and then Activate.

- Upon activation, go to WooCommerce > Conditional Payments. You’ll be presented with a user-friendly dashboard where you can manage payment restrictions.

- Customization Parameters:

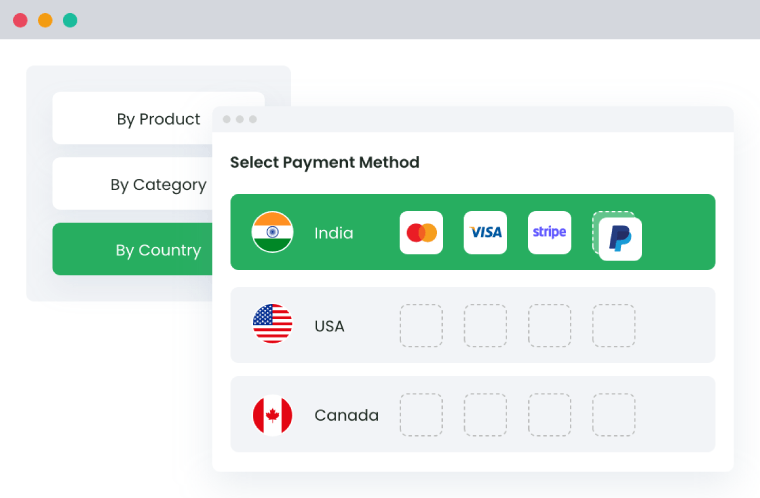

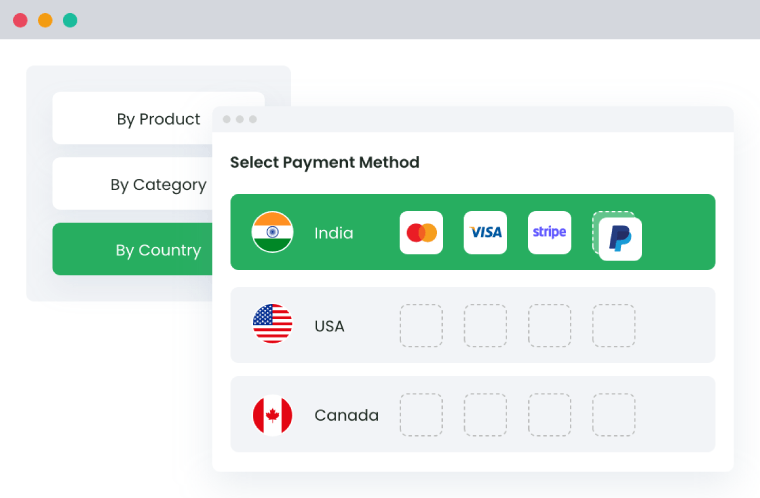

- Geographical location – Show or hide payment options like PayPal, based on the customer’s country.

- Payment gateway – Disable costly payment gateways for low-value orders.

- Product type – Offer specific payment options like you can enable COD for particular product categories.

- Order value, customer role, and shipping method – Configure rules for each of these factors to control your payment options dynamically.

By following these steps, you’ll be able to fully customize the payment options for your store.

Setting up your first payment restriction rule

To create your first payment restriction rule, follow these simple steps:

- From the Conditional Payments settings page, select the payment method you want to restrict (e.g., Cash on Delivery).

- Set the condition for when the payment method should be restricted. For example, you can restrict COD for orders under $100 to encourage customers to use secure payment methods.

- Simply select the condition type (e.g., order value) and enter the specific limit (e.g., $100).

- After setting the rule, save the changes and go to the front end of your store. Add items to the cart to test if the restriction works correctly (i.e., COD will not show up for orders under $100).

The process is quick and easy, and the plugin’s interface makes it simple for even non-technical users to apply these restrictions efficiently.

Control payment options by product type and order value

Restricting payment methods based on product type and order value is essential for optimizing both security and transaction fees. Here’s how you can set up these rules:

For high-risk products, such as electronics or luxury items, go for more secure methods (e.g., credit cards). In the plugin settings, select the product category and assign payment methods accordingly, e.g., only allow PayPal or credit card for electronics.

For larger orders, particularly those over $500, encourage customers to use secure methods like credit cards or bank transfers to minimize fraud. Create rules based on order value that enable COD for orders under $500, but restrict it for higher-value purchases to manage risk and transaction costs.

If you can build rules around product categories and order values, you can create a seamless and efficient checkout experience for your customers.

To create and manage category-based discounts to attract more customers and increase sales, you can:

- Categorize products by risk (e.g., high-value, fragile). Analyze fraud history for high-risk categories.

- Create rules:

- High-value orders: Restrict to secure methods (credit cards, digital wallets), enforce 3D Secure.

- High-risk categories: Disable COD, prioritize secure gateways.

- Fragile items: Encourage COD (with safeguards), require signatures.

- Configure rules in your e-commerce platform based on product categories, cart values, and shipping addresses.

- Track key metrics (fraud rates, chargebacks), analyze data, and update rules accordingly.

- Clearly communicate payment restrictions to customers.

By implementing these rules, you can reduce fraud risk, improve order fulfillment, and enhance customer trust while maintaining operational efficiency.

Prevent fraud with location and customer role rules

Dotstore’s Conditional Payments for WooCommerce plugin provides an effective way to prevent fraud by restricting payment methods based on location and customer roles. Here’s how to set up these advanced rules:

Location-based rules: Users can restrict specific payment methods for high-risk regions or countries. For instance, you might want to disable bank transfers for international orders where fraud is more prevalent. To do this, go to the plugin settings, select Geolocation, and specify which regions or postal codes will trigger the restriction.

Customer role rules: Users can restrict payment methods based on customer roles (e.g., new customers vs. registered users). With customer-specific conditional payment rules, the WooCommerce checkout experience becomes more personal. Payment options can be tailored based on things like whether a customer is logged in or their role, such as wholesale or retail.

It’s a simple, flexible, and budget-friendly way to offer the right payment choices to the right customers. This can help prevent fraud by allowing only trusted customer groups to access specific payment methods. For instance, you can disable higher-risk payment options for new customers and allow them for repeat buyers only.

Configure wholesale and B2B payment options

Dotstore’s plugin also allows you to tailor payment methods for wholesale or B2B customers. Here’s how to configure payment options for different customer groups:

Set payment rules for wholesale customers: Create rules that are specific to wholesale customers, such as enabling credit card payments for bulk orders and restricting them for smaller retail orders. In the plugin settings, define a rule for wholesale customer roles and link it to the appropriate payment methods.

Customer role-based restrictions: For B2B customers, you can set up different payment methods based on order value, payment methods based on shipping, or even customer type. For example, for high-value B2B orders, restrict payment methods like PayPal, which might have high fees, and only allow bank transfers or credit cards.

Location-based rules for wholesale: If you have specific wholesale customers in certain countries, you can create location-based rules to show payment methods tailored to their region, ensuring an optimized payment experience.

By combining customer roles, order values, and geographic location, you can fine-tune your payment process for your wholesale or B2B clients.

Alternative conditional payment plugin options

While Dotstore’s Conditional Payments for WooCommerce plugin is the top choice for flexibility and ease of use, there are other plugins available. Here’s a quick look at three popular options and why Dotstore’s plugin stands out.

1. Conditional Payment Methods for WooCommerce by StoreApps

This plugin allows store owners to restrict payment methods using simple rules.

- Create unlimited payment method restriction rules.

- Limit payment methods based on conditions like billing and shipping fields.

- Straightforward setup for basic restrictions.

While useful for simpler setups, this plugin doesn’t offer advanced controls like product-specific conditions or geolocation, which some stores may need for more precise customization.

2. YITH Payment Method Restrictions for WooCommerce

YITH’s plugin is a flexible tool for managing payment options across products and categories.

- Enable or disable payment gateways using multiple conditions.

- Create rules based on product categories, tags, user roles, or cart totals.

- Apply geolocation rules using IP address or billing country.

- Automatically switch bank accounts based on purchase conditions.

Although packed with features, the plugin’s complexity might be overwhelming for store owners who prefer an intuitive interface with clear documentation.

3. WooCommerce Conditional Payments by Product & Country

This WPFactory plugin provides extensive options for hiding payment methods based on various criteria.

- Restrict payment gateways by cart total, user role, customer IP, or date.

- Supports all WooCommerce payment gateways, including custom ones.

- Advanced conditions include language, currency, and product categories.

While offering a wide range of features, the user interface may feel more suited to technical users rather than those looking for a beginner-friendly solution.

These plugins all have their strengths, from handling basic restrictions to offering advanced options for larger stores. For store owners looking for a balance between ease of use and robust functionality, it’s worth exploring solutions like the Dotstore’s Conditional Payments plugin that combine flexibility with seamless configuration and support.

Really great support, excellent add-on. These guys really helped me out when setting this up for what, in my mind at least, was a complex set of conditions. Add-on works fine.”

Kelseyroth, CEO – M2Media

Best Practices for Conditional Payments in WooCommerce in 2025

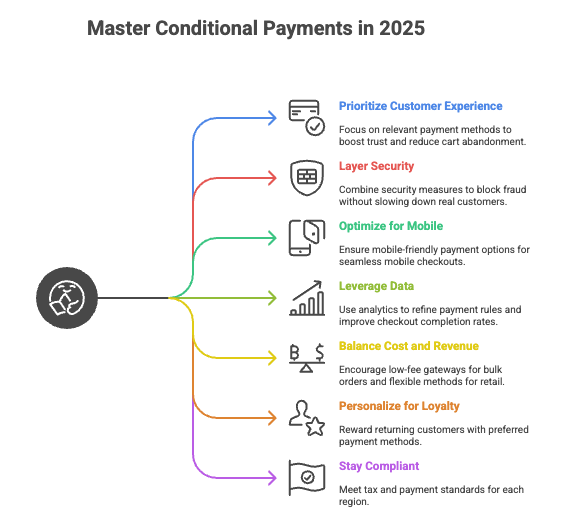

In 2025, conditional payments are becoming a standard for WooCommerce stores that want to balance convenience, security, and profitability.

Here are the best practices to follow:

- Prioritize customer experience first: Only show payment methods that are truly relevant to the buyer’s region, order size, or product type. A clean, simplified checkout boosts trust and reduces cart abandonment.

- Layer security into payment rules: Fraud is evolving, so combine location-based restrictions, order-value rules, and IP tracking to block high-risk transactions without slowing down real customers.

- Optimize for mobile checkouts: Most buyers now complete purchases on their phones. Ensure conditional payment rules display mobile-friendly gateways like wallets (Apple Pay, Google Pay) where relevant.

- Leverage data-driven decisions: Review analytics regularly — track which payment methods lead to completed checkouts vs. abandoned carts. Use this data to fine-tune your rules.

- Balance cost with revenue: Set rules that encourage secure, low-fee gateways for bulk or wholesale orders, while reserving flexible methods like PayPal for smaller retail orders. This keeps profits healthy.

- Personalize for loyalty: Create conditional rules that reward returning customers or wholesale buyers with preferred payment methods, making their checkout smoother.

- Stay compliant with local regulations: Ensure your rules meet tax and payment compliance standards for each region you sell in, especially if you operate internationally.

- By following these best practices, WooCommerce store owners can use conditional payments not just to simplify checkout but to boost conversions, protect against fraud, and cut unnecessary costs.

FAQs on Conditional Payments in WooCommerce

What are conditional payments in WooCommerce?

Conditional payments in WooCommerce allow store owners to show or hide payment methods based on specific rules like product type, cart total, customer role, or location. This ensures customers see the most relevant and secure payment options during checkout.

Why should I use conditional payment rules in my WooCommerce store?

Using conditional payment rules helps reduce cart abandonment, prevent fraud, lower transaction costs, and improve customer trust. By tailoring payment methods to each situation, you can balance convenience with profitability.

Can I restrict Cash on Delivery (COD) for certain orders?

Yes. With conditional payment plugins, you can disable COD for high-value or high-risk orders while keeping it available for low-value or local deliveries. This improves security and reduces fraud.

How do conditional payments help prevent fraud?

By blocking risky payment methods in specific regions, limiting certain gateways for new customers, or applying rules to high-value transactions, WooCommerce stores can reduce chargebacks and fraudulent orders.

What plugin is best for managing WooCommerce conditional payments?

Dotstore’s Conditional Payments for WooCommerce plugin is one of the best options. It offers rules based on order value, location, product type, shipping method, and customer role, all through a simple interface.

Do conditional payment rules work for wholesale or B2B stores?

Yes. You can create custom rules for wholesale or B2B customers, such as enabling bank transfers for large orders and disabling expensive gateways for smaller ones. This makes checkout more efficient for different customer groups.

Are conditional payments in WooCommerce mobile-friendly?

When implemented with the right plugin, conditional payments are fully compatible with mobile checkouts. You can prioritize gateways like Google Pay, Apple Pay, or digital wallets for mobile users.

Conlusion: Start optimizing your WooCommerce conditional payment rules today

Conditional payments in WooCommerce reduce fraud, improve conversions, and cut down on payment processing costs. By setting rules based on location, order value, customer role, and product type, you give your customers the right payment options while keeping your store protected.

With Dotstore’s Conditional Payments for WooCommerce plugin, you can:

- Block risky payment methods in high-fraud regions.

- Offer tailored payment options for wholesale and B2B buyers.

- Encourage cost-efficient payment gateways to save fees.

- Simplify checkout so customers complete purchases faster.

Don’t let complicated or risky payment methods hurt your sales.Download Dotstore’s Conditional Payments plugin and start creating a smarter, safer, and more profitable checkout experience for your store.

Conditional Payments For Woocommerce

Reduce risk and supercharge your conversions with strategic payment limitations.

14-day, no-questions-asked money-back guarantee.